Moving Your Money from Big Banks to Safer Credit Unions or Community Banks

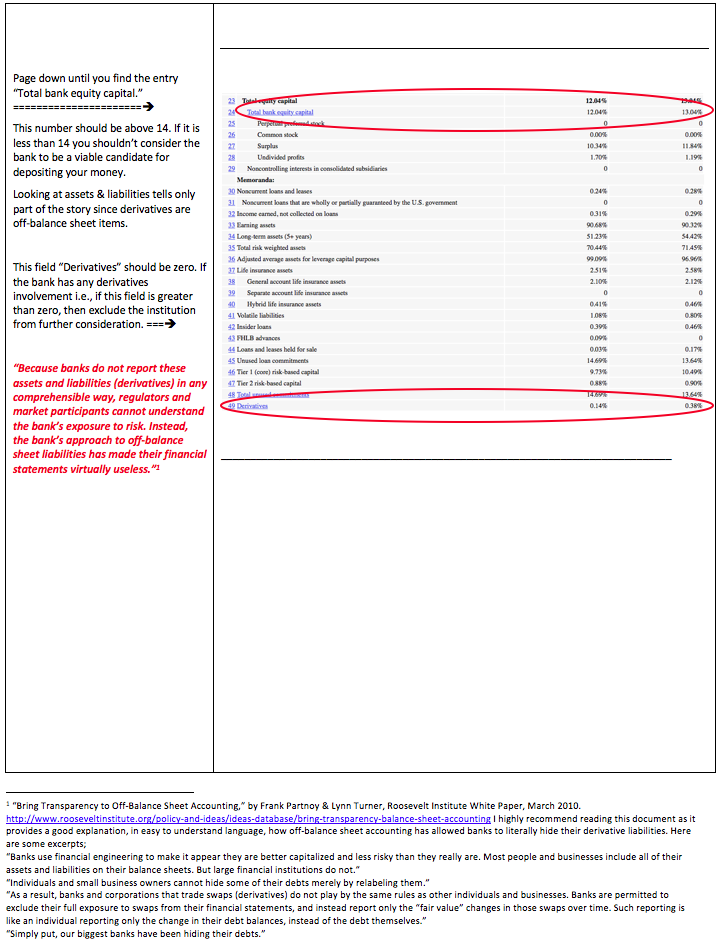

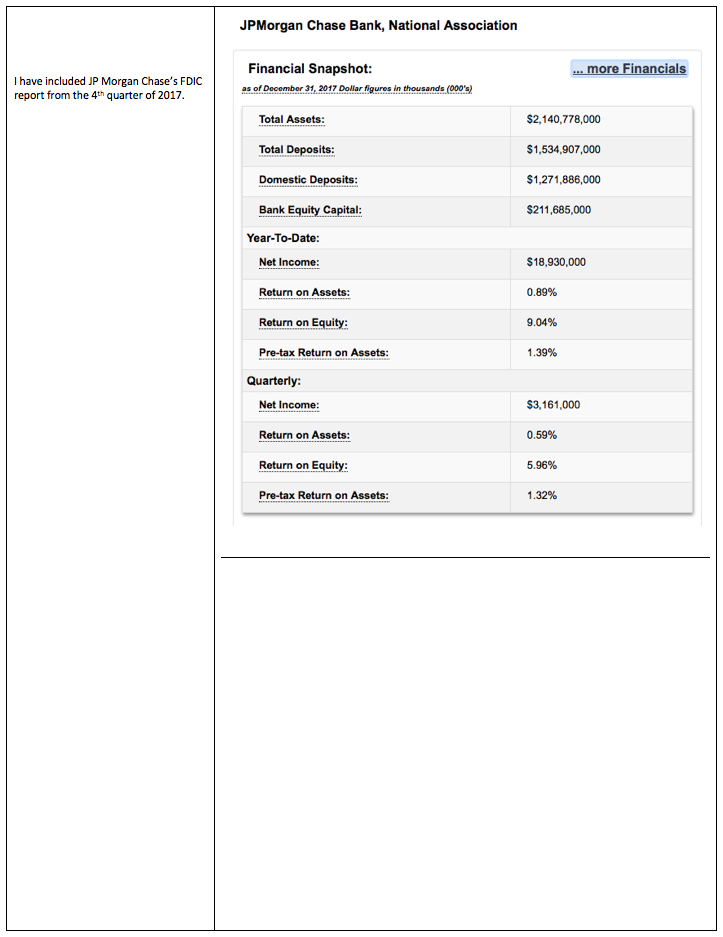

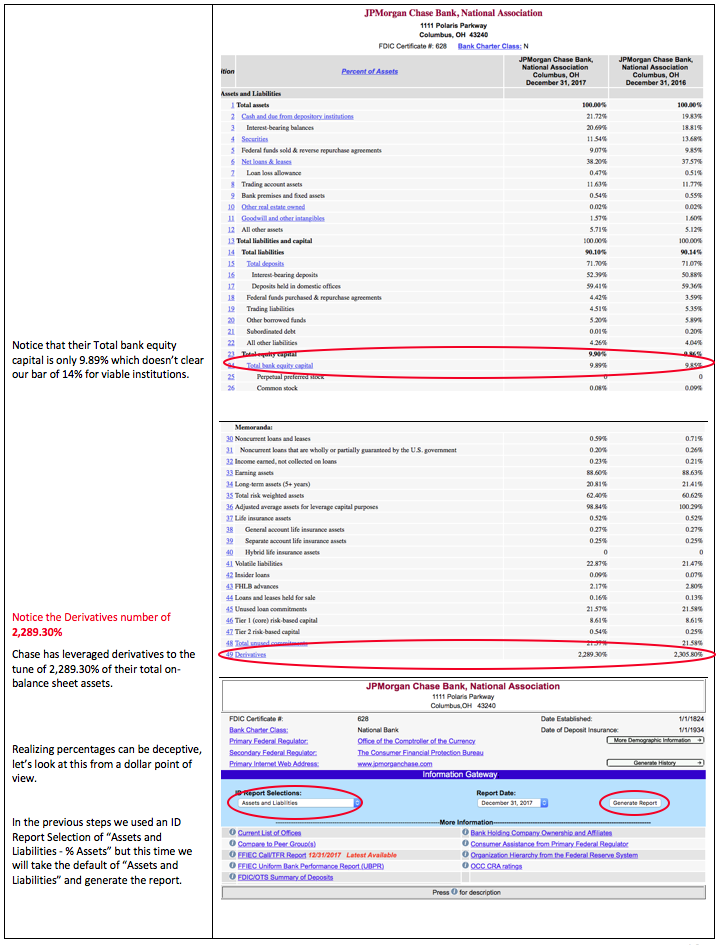

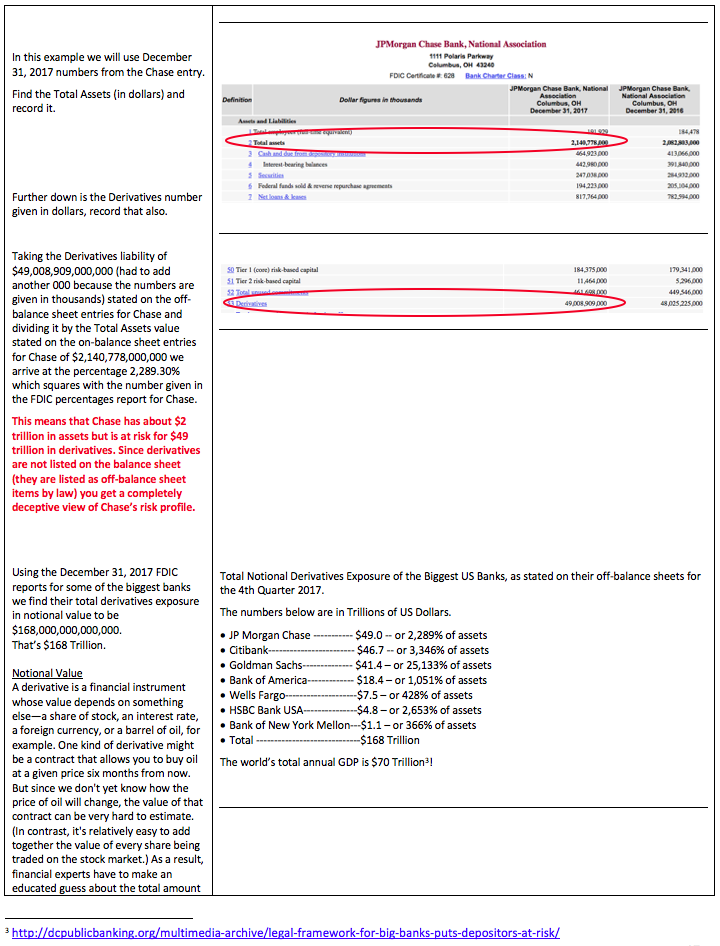

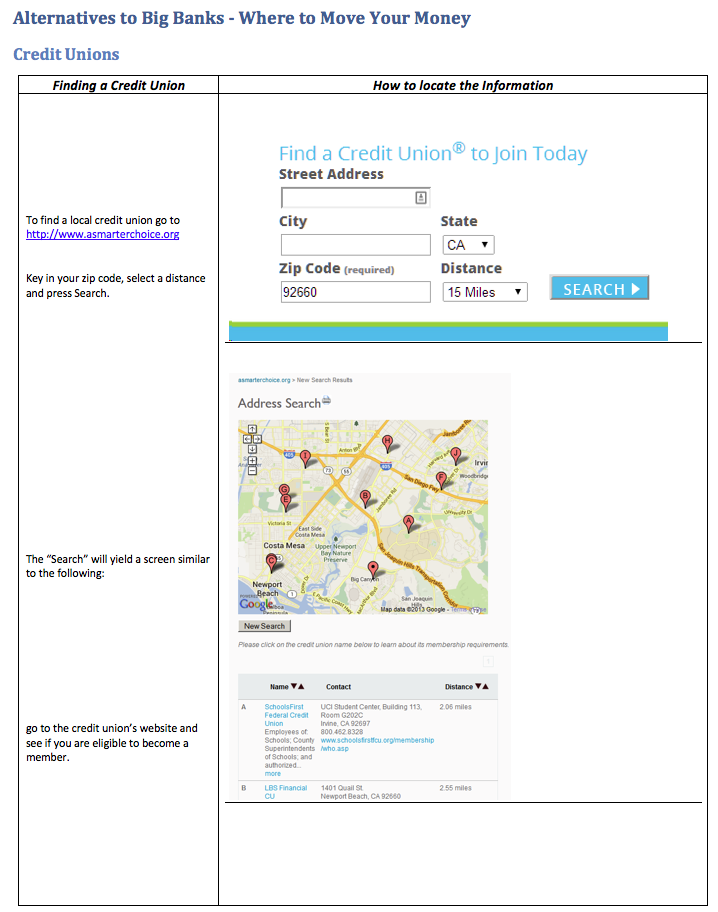

At this time, the safest place to put your money is into a credit union or a community bank. By "safe" I mean that the probability of losing your money is extremely low compared to a big bank. By definition, a big bank is any financial institution performing derivatives trading. The big banks executing derivatives have an exponentially higher risk exposure than a credit union because the credit union is non-profit and usually has not purchased any derivatives.

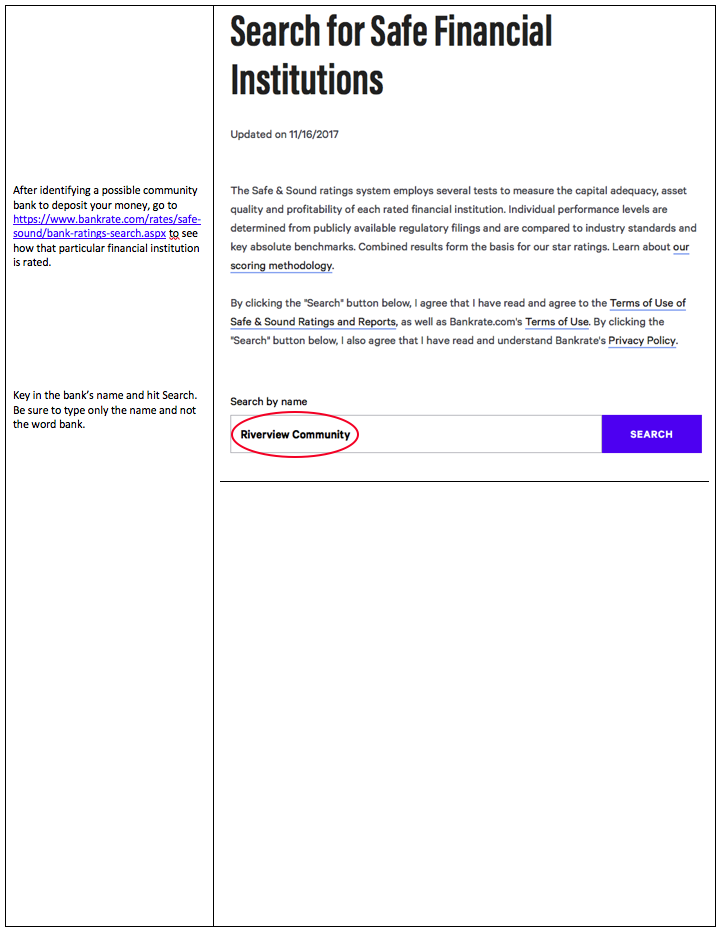

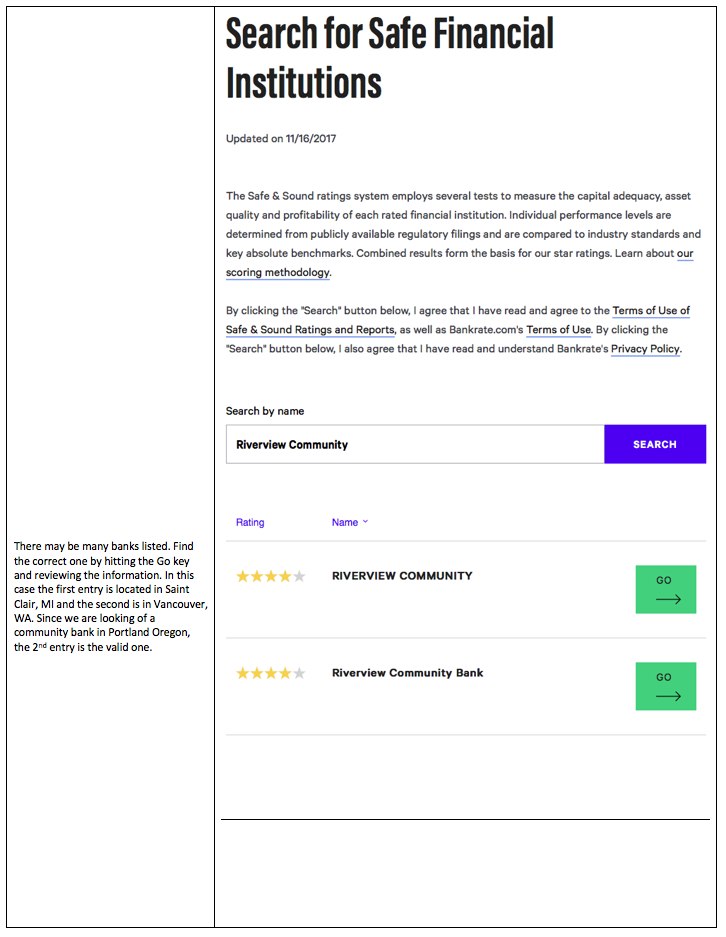

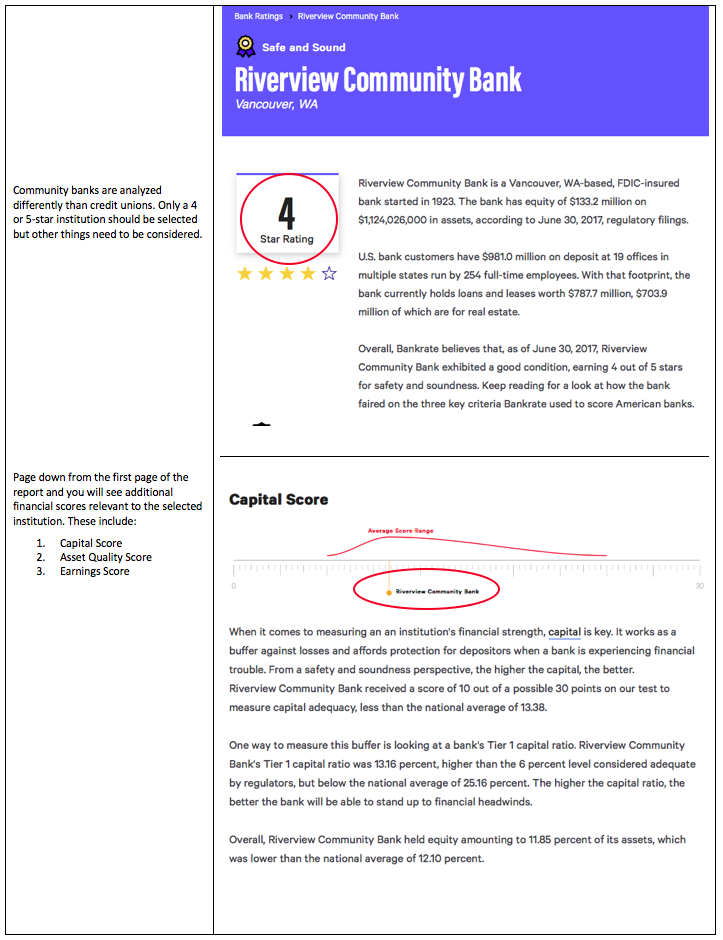

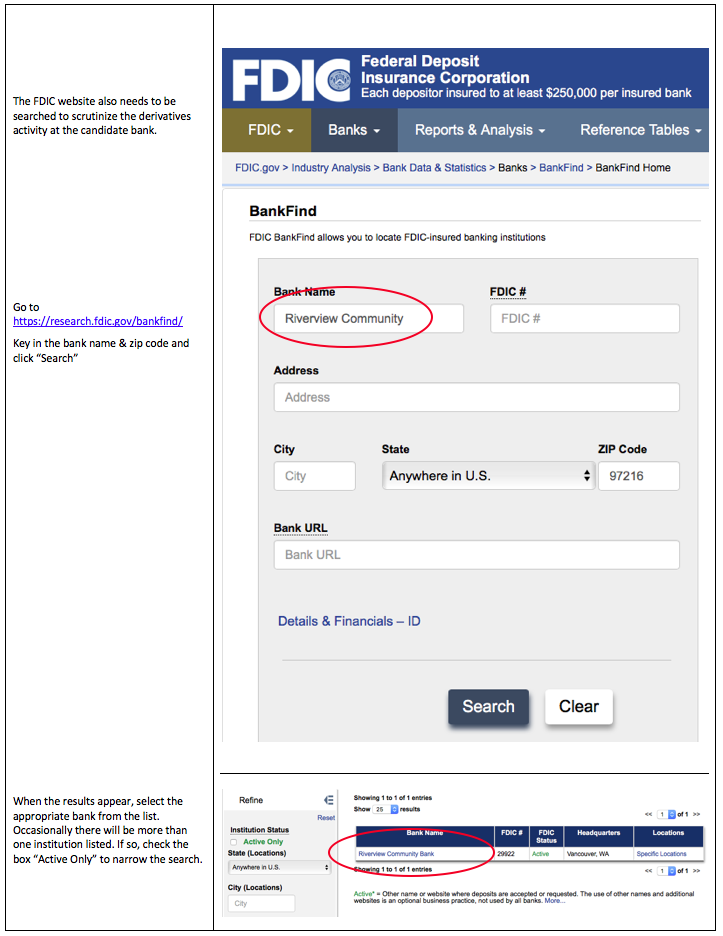

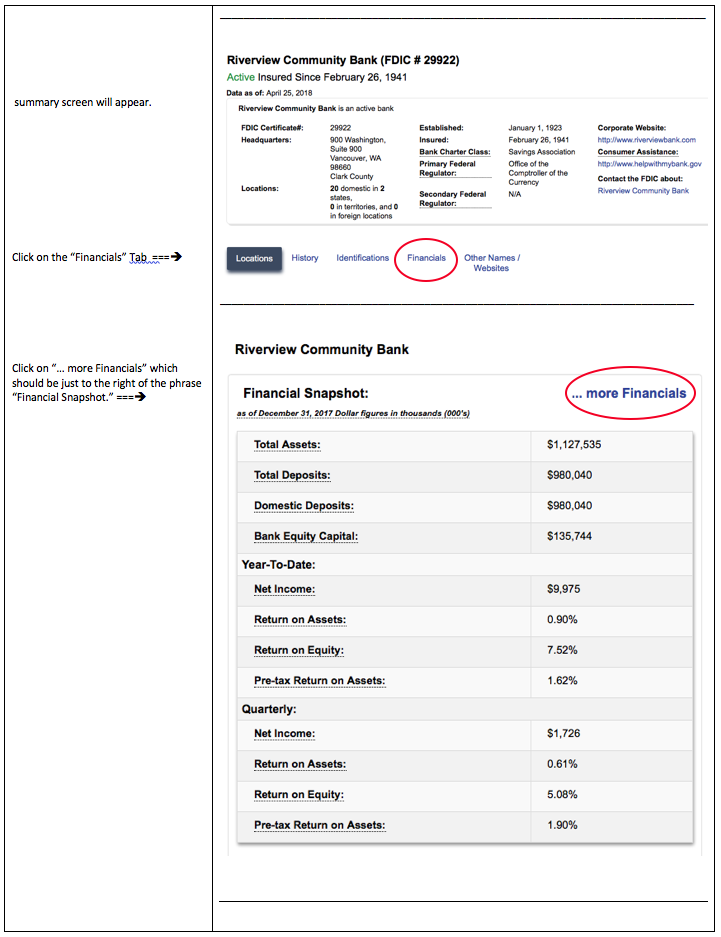

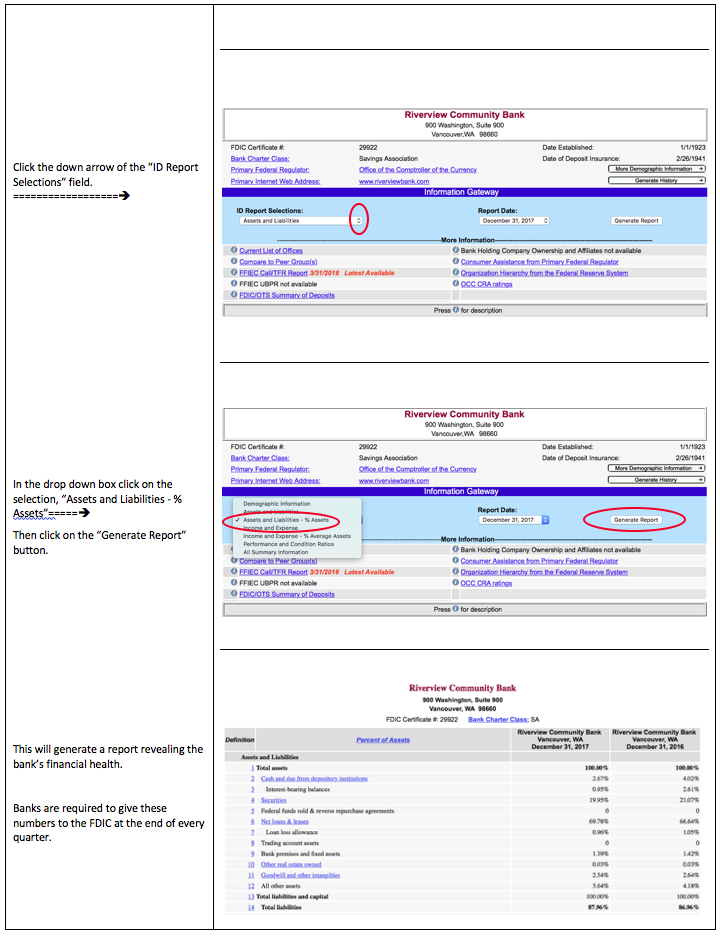

What follows is a step-by-step tutorial how to find and rate a community bank or credit union.

What follows is a step-by-step tutorial how to find and rate a community bank or credit union.

| Alternatives to Big Banks - Where to Move Your Money.pdf | |

| File Size: | 2370 kb |

| File Type: | |

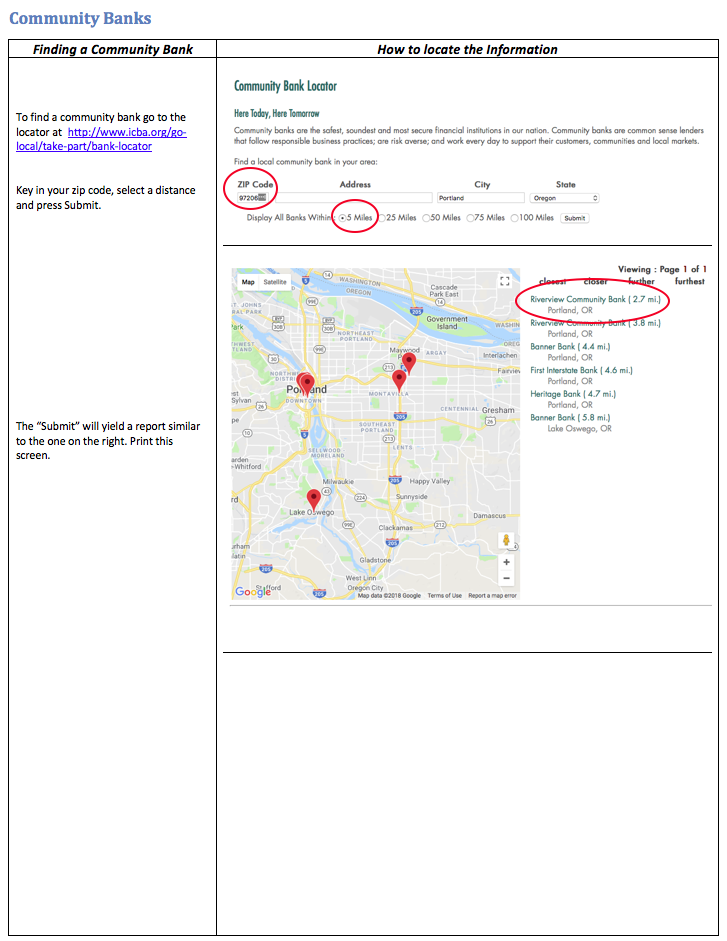

A community bank is a depository institution that is typically locally owned and operated. Community banks tend to focus on the needs of the businesses and families where the bank holds branches and offices. Lending decisions are made by people who understand the local needs of families, businesses and farmers. Employees often reside within the communities they serve.

Just below is a step-by-step tutorial how to find and rate a community bank.

Just below is a step-by-step tutorial how to find and rate a community bank.

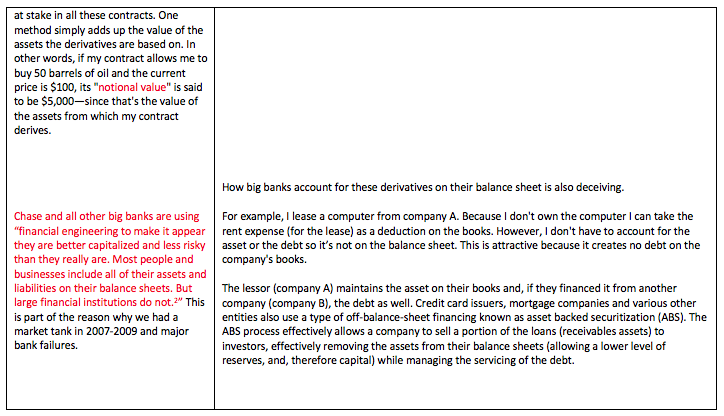

A credit union is a cooperative financial institution in which individuals pool their money to provide loans and services to other members. In the United States, credit unions are nonprofit entities, and their cooperative structure is designed to ensure fair dealing. The idea behind credit unions is that they provide services that are tailored to the people who use them, rather than to driving profit for the institution. Additionally, anyone who belongs to a credit union must first qualify to join under a particular institution's field of membership.