Did you know...

- All money in the US, except coins, is loaned into existence.

- Money is created out of debt.

- Money = debt

- The entire US money supply consists of debt to private banks for money they created on their computers. Banks manufacture money out of nothing.

- 97% of money exists only as computer records.

- Roughly 30% of the money created by banks with accounting entries is invested in their own accounts.

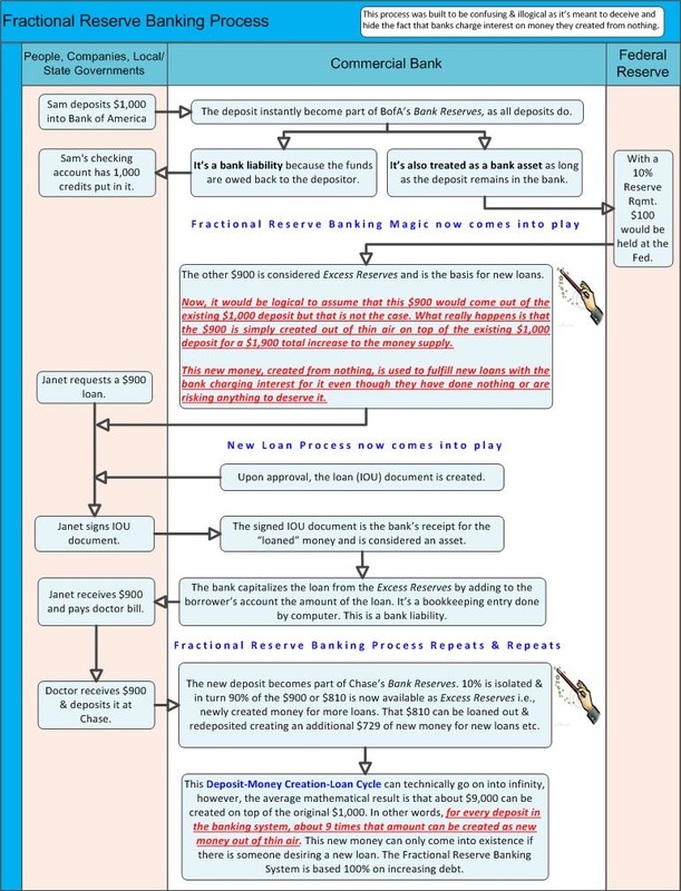

- When a bank makes a loan, it simply adds to the borrower’s deposit account in the bank by the amount of the loan. The money is not taken from anyone else’s deposit; it was not previously paid in to the bank by anyone. It’s new money, created by the bank for the use of the borrower. Money creation is done by building up deposits, and this is done by making loans. Contrary to popular belief, loans become deposits rather than the reverse i.e, deposits becoming loans.

- When the Federal Reserve writes a check for a government bond it does exactly what any bank does, it creates money. The Fed creates money purely and simply by writing a check drawn on an account with nothing in it.

- Federal income tax was instituted specifically to coerce taxpayers into paying the interest due to banks on the federal debt. If the money supply had been created by the government rather than borrowed from banks that created it, the income tax would not have been necessary.

- The problem is that all money except coins comes from banker created loans, so the only way to get the interest owed on old loans is to create new loans.

- The process to create money through private banks is actually very simple i.e.,entering numbers into a computer screen. However it is intentionally obfuscated to allow the concentration of wealth to be invisible.

- The Federal Reserve is composed of 12 branches, all of which are 100% owned by private banks in their district. They are so private that their stock is not even traded on the stock exchange. The government doesn’t own them. You & I can’t own them. They are owned by a consortium of private banks. Among the largest are Citibank & JP Morgan Chase, the financial cornerstones of the empires built by JP Morgan & John D Rockefeller, the robber barons who orchestrated the Federal Reserve Act of 1913.

How Banks Create Money from Nothing

Throughout history two separate monetary systems have competed for dominance within countries:

- Government creates money (sovereign money) - used as a transaction mechanism with no inherent debt attached.

- Private banks create money - this system requires the Government to borrow the money from private banks and pay interest to the private bank owners. In this case money can only be borrowed into existence. It is irrational to have this system of monetary creation since the Government could create money itself for free. This system is only in place to enrich bankers.

| How banks create money from nothing - detailed flowcharts.pdf | |

| File Size: | 5232 kb |

| File Type: | |